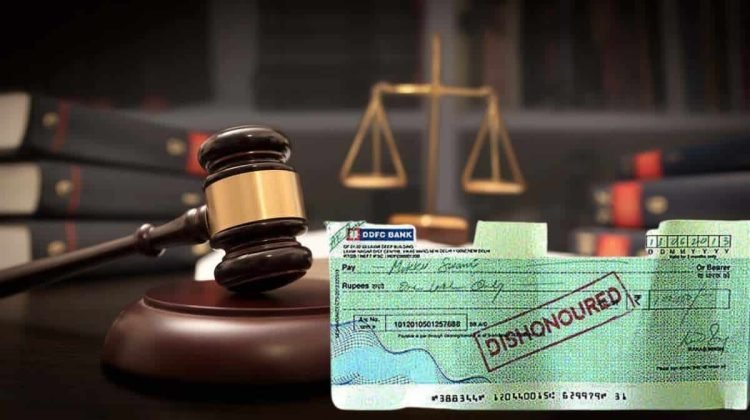

“Dishonor of Cheque: Legal Implications & Remedies for Financial Protection”

A cheque is a widely used financial instrument that facilitates smooth transactions. However, when a cheque is dishonored, it can lead to legal complications and financial loss. Understanding the legal implications and available remedies is crucial for both issuers and recipients of cheques.

What is Dishonor of Cheque?

Dishonor of a cheque occurs when a bank refuses to process the payment due to insufficient funds, signature mismatch, account closure, overwriting, or other banking discrepancies. This situation is legally addressed under Section 138 of the Negotiable Instruments Act, 1881 (NI Act) in India.

Legal Implications of Cheque Dishonor

A dishonored cheque can lead to both civil and criminal liabilities, depending on the circumstances. The legal consequences include:

-

Notice to the Drawer

- The payee (recipient) must send a legal notice to the drawer (issuer) within 30 days of receiving the dishonor memo from the bank.

- The notice demands payment within 15 days from the date of receipt.

-

Filing a Case Under Section 138 NI Act

- If the drawer fails to make the payment within the stipulated period, the payee can file a criminal complaint before the magistrate within 30 days after the 15-day notice period expires.

- If convicted, the drawer may face:

- Imprisonment of up to 2 years

- Fine up to double the cheque amount

- Both imprisonment and fine

-

Civil Suit for Recovery

- Apart from criminal liability, the payee can file a civil suit for recovery under the Civil Procedure Code (CPC), 1908, to claim the due amount along with damages and interest.

-

Banking Consequences

- Repeated dishonor of cheques can lead to account suspension or blacklisting by banks, affecting the drawer’s financial credibility.

Remedies for Financial Protection

To safeguard financial interests, both cheque issuers and recipients should follow these preventive and corrective measures:

For Payees (Recipients of Cheques)

✅ Verify Funds Availability – Before accepting high-value cheques, ensure the drawer has sufficient balance.

✅ Send Legal Notice Promptly – If a cheque bounces, issue a legal notice within the prescribed timeframe.

✅ File a Criminal Complaint – If payment is not made after the notice, take legal action under Section 138 NI Act.

✅ Opt for Civil Recovery – Parallel to criminal proceedings, file a civil suit for full recovery, including damages.

For Drawers (Issuers of Cheques)

✅ Maintain Sufficient Balance – Always ensure enough funds in the account before issuing a cheque.

✅ Avoid Signature Mismatch – Use consistent signatures to prevent technical dishonor.

✅ Respond to Legal Notices – If you receive a notice, settle the amount or provide a legitimate response within 15 days.

✅ Negotiate Settlement – Try to settle the dispute through mutual agreement to avoid legal complications.

Conclusion

The dishonor of a cheque is a serious financial and legal matter that can lead to imprisonment, fines, and damage to financial credibility. Both parties must exercise due diligence while issuing and accepting cheques. For those facing cheque dishonor issues, seeking professional legal advice ensures effective legal remedies and financial protection.